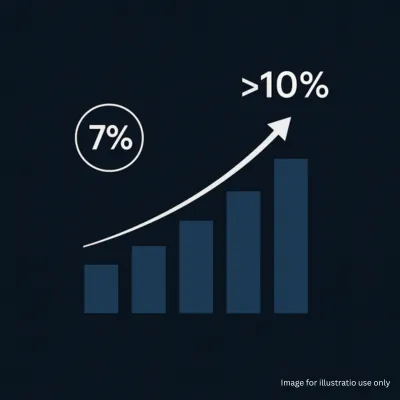

Earn 7–10% Annual Return Backed by Real Property

Tired of tenant issues, property maintenance, negative cashflow and high renovation cost just to wait many years for some capital gain?

For property investors who want more, without the hassle, we invite you to discover a new form of cash flow generating asset, developed and backed by experienced property developer at super prime Johor location through preferred shares.

Consistent and predictable annual returns of 7-10%

Exposure to real property asset managed by global hospitality brands like Hyatt and Oakwood

No need to pay for stamp duty, legal fees, or renovations

Capital gain of 130% via buyback or 300% via REIT IPO listing

No landlord headaches

Why This Instead of Traditional Property Investment?

A Quiet Shift in Real Estate Investing

Most investment grade / commercial property require:

More than RM500k in capital

Long-term lock-in for capital gains

Capital gain tax

Endless tenant management

High cost of maintenance or property repair

Negative Cashflow

This opportunity simplifies investing in 2025.

✅ Low entry barrier (under RM250k)

✅ Earn 7–10% returns annually — even in a slow market

✅ Backed by real estate in a high-demand location driven by tourism & easy access to Singapore

✅ Returns come from operating income, not speculation

✅ Hands-off — no tenants, no repairs, no waiting for appreciation

How It Works?

You're investing in a Private Equity REIT on a premium hotel asset strategically located in the heart of Johor Bahru, 5 minutes from the CIQ and RTS Link.

The property is:

🏨 Managed by an international hotel chain

📍 Located in a high-footfall, high-demand area with 13M+ tourist visits/year

💵 Generates income from rooms, F&B, events, advertising and parking

📈 You receive predictable net income from and guaranteed capital gain via 130% buyback by developer

Now: Let Your Capital Work Smarter

Investors with RM50k and above in deployable capital

Whether you’re a seasoned landlord or a cautious investor looking for a safe and respectable return, this is your chance to diversify without overcommitting.

🏢 Backed by real property

📈 Returns better than many real estate or mutual funds

🧘♂️ No day-to-day involvement needed

🔓 Low barrier of entry

Important Disclaimer

This is not a property launch, public seminar, or MLM gathering. This is a private investor session, open to individuals who meet certain qualifying criteria. If you value discretion, real assets, and a forward-looking approach to wealth, we invite you to explore this further.

Interested in seeing the numbers, locations, and past performance?

Prime Freehold Location

Quayside JBCC occupies freehold land in Johor Bahru’s Cultural Heritage Zone, granting investors permanent land ownership and unparalleled stability . It is located just 1 km from the CIQ customs complex, with a six-minute drive to the upcoming RTS link to Singapore, ensuring seamless cross-border connectivity for both Malaysian and Singaporean investors .

Iconic Hospitality & Amenities

Quayside JBCC is operated by Hyatt Place (4★ hotel) and Oakwood serviced residences, delivering exceptional guest experiences and strong occupancy rates . The development features Malaysia’s first 270-degree cantilevered rooftop infinity pool alongside a full-tower LED advertising facade, creating high prestige and additional revenue opportunities .

Diversified, Recurring Income

The fund’s cash flow is supported by hotel room bookings, MICE events, food and beverage outlets, retail leasing, multi-storey car parking, and digital out-of-home advertising . Tapping into these varied streams reduces volatility and smooths quarterly dividend distributions in line with Johor’s growing tourism and commercial demand .

Regulated Structure & Attractive Returns

The investment is structured as a closed-end private equity fund under the Securities Commission Malaysia, providing robust governance, professional oversight, and full regulatory compliance . Investors are targeted to receive a committed 7 % p.a. dividend with a total return goal exceeding 10 % p.a., along with a clear exit strategy via REIT public listing starting in 2032 .